$ATTO - Classic "Steak and Sizzle" Special Situation

Slam Dunk Buyout Thesis with a Free Option on Business Turnaround

Introduction

As my subscribers may already know, I love deep-value investments with multiple ways to win. My recent pitch on Trecora Resources (linked here) is a good example, because the setup incorporates both improving fundamentals and strategic alternatives, potentially unlocked by activist pressure. In this vein, I have another idea that I’d like to share with you – Atento SA (NYSE: ATTO), which I believe is one of the most interesting special situations that I’ve come across in recent memory.

Atento is a CRM/BPO provider with presence in LATAM, Europe and North America. ATTO flies under the radar for the most part with only a $397mm market cap, but offers a compelling investment opportunity for the following reasons:

ATTO is in the middle of a successful (to date) 3-year turnaround plan focused on sustainable organic growth and margin expansion, led by a strong management team

ATTO will benefit from secular tailwinds in the CRM/BPO industry, and the Company is investing appropriately to capitalize upon the opportunities

The Company is clearly undervalued on a relative and an absolute basis, yet punished unfairly by the markets as the ongoing investments mask the true normalized FCF of the business

Atento is a slam-dunk candidate for strategic alternatives, and it is my personal opinion that the business is sold within the next 12 months, yet the market is completely asleep at the wheel

Business Overview / Company History

Atento is one of the largest CRM/BPO providers in LATAM, with further presence in North America and Europe. The Company provides a full suite of solutions, including outsourced call centers, customer care, technical support, collections, marketing and other back-office functions. The Company is also developing and offering “next gen” capabilities such as AI-assisted voice, multichannel and analytics products, which provide further value-add in the digital age, and will help drive growth in the coming years. To put some numbers around the business, 2020 revenue breakdowns were: 43% Brazil, 41% other LATAM/US, and 16% EMEA/Other. Telefonica is by far the largest customer at ~32% of total revenue, but customer concentration issues are to a large extent mitigated by the fact that the Company has 106 arm’s length contracts with various subsidiaries and business units of Telefonica (as of 2020).

The Company has somewhat of a wild history in terms of ownership and capital structure. Atento was initially part of Telefonica, but became an independent entity when it was carved-out and sold to Bain Capital in 2012. Bain subsequently IPO’ed the business in 2014, and concurrently took a large portion of their equity basis off the table, by issuing a private loan backed by the shares that they owned at the time. The deal was done at the Lux HoldCo which owned Bain’s shares, and the financing was provided by HPS, GIC and Farallon (the “Big 3”) at a 13.25% PIK interest rate, with the notes maturing in May 2020.

The Company largely underperformed Bain’s expectations since the initial buyout and IPO, driven by mediocre underlying performance, exacerbated by FX headwinds during the time period as the LATAM currencies depreciated significantly vs. hard currencies. COVID was the nail in the coffin, and Bain made the decision to hand over the shares to the creditors rather than repaying them at maturity (given that credit markets at the time did not allow for a refi). As such the Big 3 became majority shareholders, owning ~62% of outstanding shares.

3-year Turnaround Plan

As alluded to earlier, performance was poor from 2014 – 2018, and the new CEO and CFO took the reins in 2019. The new mgmt. team instituted a 3-year plan to deliver sustained organic growth and sequential margin expansion, and announced the details during the 2019 Investor Day, as shown below:

The business improvement plan was comprehensive, ranging from new customer/contract wins, pricing increases, developing next-gen solutions, sweeping cost controls and facility footprint rationalization. Margin expansion was the core of the focus, and the strategy was to gradually de-emphasize and exit lower margin legacy contracts (mainly with Telefonica) and replace them with higher margin business – rapidly growing Multisector and the US operations, for instance.

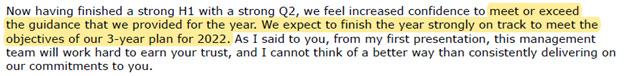

The management team has quietly done a great job so far, with the margin progression well on track to meet 2022 guidance of 14-15% EBITDA margins. The Company is firing on all cylinders right now, with the most recent 2Q’21 quarterly earnings printing strong organic growth – 14% YoY for Multisector and 33% YoY for the US business. Management is highly confident of strong results for 2H’21, with commentary such as the snippet below from the 2Q’21 earnings call:

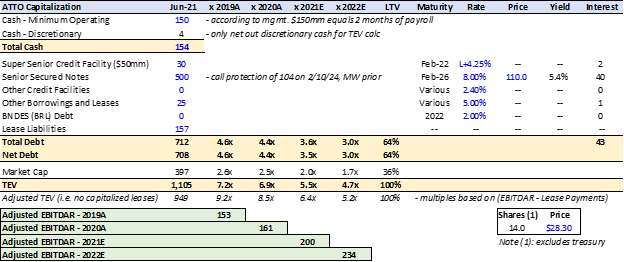

And before we move onto discussing the “sizzle” of the story, here is an illustration of the current capital structure, which provides helpful framing:

If mgmt. is able to achieve 2022 guidance as outlined in the 3-year plan, I expect 2022 EBITDA to reach $234mm, at the midpoint of margin range (14-15%). If we then calculate normalized FCF by adding back growth capex and W/C investments to support growth (which should come off in 2023), I arrive at $70-80mm of LFCF, which equates to ~20% yield on market cap, which I believe is quite cheap for a company with many years of runway for organic growth and further margin expansion.

Strategic Alternatives

As discussed above, I think the fundamental business case for investing in ATTO is quite compelling. However, the event-driven angle here in regards to an eventual buyout is just as exciting, and offers the prospective investor a second way to win. Taking a step back though, it is worth examining why strategic alternatives for ATTO is a question of when, not if:

As a result of the Share Transfer Agreement in June 2020, the Big 3 now own 62% of all outstanding shares (for sake of simplicity I’m using 15mm shares out including 1mm of shares in treasury). Now, we must note that HPS, GIC and Farallon invested in ATTO as opportunistic credit investors, who typically do these creative deals to earn attractive returns (in this case 13.25% PIK plus OID/fees) without directly taking equity risk. The credit vehicles typically dislike holding equity in a publicly traded company from a LP mandate perspective, and also because of the headaches that come with a publicly traded position (not to go down a rabbit hole but firms typically have some leeway to mark private positions in any way that suits them, and this is not possible for public securities with a “fair market” price out there). The Big 3 have been involved with ATTO since 2014, so they are keen to exit the investment as long as they can generate an acceptable IRR. So what price would be good enough for them? Well, we can figure this out from the cost basis disclosed in the Share Transfer Agreement of 2020, which I summarized below:

To clarify a bit further, “opportunistic credit” funds that do deals like this typically have a ~8% preferred return hurdle for LPs, and after management fees, fund-level expenses and catch-up provisions, they need to generate 11-13% IRRs to earn full underwritten carried interest for the deal. If they can sell the business for at least ~$60/share by June 2022 (which is when their lockup expires), this would be a terrific outcome for the Big 3.

This raises a very interesting question in a game-theory context, because the decision algorithm for the Big 3 can get pretty complex – in that we have a very undervalued business undergoing a successful turnaround, but there are limits to how long they can hold this asset. Of course every extra dollar flows directly through to the bottom line, but one could potentially argue that the Big 3 are incentivized to smack the bid to any buyer that comes along to offer $50-60/share today. So why would any buyer offer to pay more than this unless there was a competitive auction in place?

This is where the often-discussed concept of reflexivity comes in. ATTO has an element of “creating your own destiny” here for the marginal buyer given the stock trading at a steep discount to the cost basis of the big holders. In any auction for a public company, there is a typically accepted range of premiums paid to the unaffected share price, so optics are highly relevant, and you are unlikely to see premiums exceeding 50%, as a general rule of thumb. This all means that the unaffected trading price of ATTO is likely to have a significant bearing on the price that is eventually struck for the transaction.

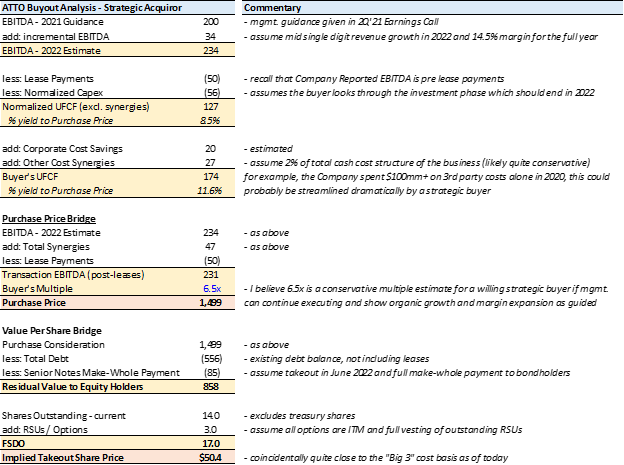

Let’s take a quick pause here because we also need to make sure that any theoretical blue-sky takeout price for ATTO is still accretive for a strategic buyer, otherwise the whole reflexivity exercise becomes moot. We are lucky in this regard, because the math can get extremely compelling for a strategic buyer looking to acquire ATTO. Please see the below straw-man buyout math that I have formulated:

I believe that the above analysis is quite conservative for several reasons, including the following:

I have taken the midpoint of mgmt. guidance for 2022, and I believe that mgmt. has intentionally set a low bar for themselves, implying significant upside upon further execution

Synergies with the right strategic buyer could be massive – but given that I am not an M&A or integration expert, I have only given credit for a de-minimis amount of cost synergies

I believe that 6.5x EBITDA multiple is a very conservative number, especially if the acquiror can underwrite to a long runway of continued organic growth. For context, scaled BPO businesses with better margin profiles trade for low to mid-teens EV/EBITDA multiples

ATTO requires ~$150mm of minimum operating cash on the B/S to have liquidity for 2 months of payroll, and therefore I have not deducted this cash from EV when looking at the business on a standalone basis. However, a strategic acquiror with better W/C management benefits from a significant release of working capital, which effectively lowers the purchase price (not included above for conservatism)

For context, let’s also review where the public comps trade to highlight the glaring multiple differential between Atento and the comp set:

As a final data point, the industry is also ripe for consolidation, with the most recent deal being Seitel acquiring Sykes for $2.2bn, or 10.3x 2021 consensus EBITDA, quite a healthy multiple. Considering all of these facts in aggregate, I believe that a motivated strategic acquiror can potentially pay far above $50/share if ATTO is put up for sale sometime in 2022. And even if the future sales process doesn’t play out as positively as we might hope, I believe there is a reasonable floor at $50/share.

Float Dynamics

Before we move onto the risks, I want to wrap up the thesis with the ATTO shareholder register and what that implies for the float. I think technicals related to the float dynamics are very compelling here, yet this is not obvious unless you really do the work. Please take a look at the following:

Most of this is easily verifiable from public filings. There are only 4.2mm shares in the public float, and 1.4mm of this is held by 13-F filers including Santa Lucia. Now this is where it gets interesting – based on Plum Capital diligence, approximately 1.5mm of the remaining shares are held by sophisticated investors who believe that intrinsic value is significantly higher than $50/share. I need to respect their privacy and will not disclose names here, but I am comfortable representing this given the reputation of each investor (each of them far more prominent and accomplished than I am), and the depth of diligence they conducted, which became evident during my conversations with them. Having said that, please reach out to me privately if you have done serious work on ATTO and would like to be introduced to this group, I will gladly try to help.

Ultimately this brings me to the point that there are only 1.3mm shares left (and likely even less given the possibility of other “strong hands” out there that I do not yet know about) in the float that is currently available for the market to purchase. In my personal opinion, this is an incredible opportunity for a family office or a small fund (or even sophisticated retail) to take advantage of before the remaining shares eventually get snapped up – and any incremental buying is likely to send the share price sharply higher, probably catalyzed by the upcoming quarterly earnings (which I expect to be quite strong) and the interest generated by the Investor Day planned for November.

Risks / Considerations

I strongly believe in giving a balanced view for any investment thesis, and the risks around this investment must be discussed. I will evaluate each in turn:

Execution risk

Macro risk

Controlled Company risk

The fundamental investment case is wholly predicated on the Company achieving sustained organic growth and further margin expansion. The normalized FCF profile on $200mm of EBITDAR is not something I’d consider cheap enough ($50mm of leases, $35mm of maintenance capex, $43mm of cash interest, $15-20mm of cash taxes and some W/C drag as business scales), so we really need the Company to hit their 2022 targets for us to feel good about the intrinsic value of the business and associated margin of safety. With that said, there is a rockstar management team in place who have proven themselves so far with strong execution since 2019. Both the CEO (Carlos López-Abadía) and the CFO (José Azevedo) have impressive backgrounds and a stellar reputation with investors who have followed them for many years, which gives me additional comfort.

On the macro risks, we can identify the usual suspects – LATAM economic prospects, FX risk and labor inflation risk. Each of them cannot be ignored, and is part of why this opportunity exists. In my opinion however, none of them are serious enough to break the thesis except in the most draconian of scenarios, and the team has been able to navigate them so far (e.g. passing on bulk of the labor inflation to customers to maintain/improve margins). I’d also point to the fact that the Company had a stellar 2020 performance despite the obvious challenges of COVID, by increasing both EBITDA and margins vs. 2019. I am happy to stomach the macro risks for this particular situation, given the upside on offer.

On the last point, I do want to point out that the Big 3 own majority of the equity and will ultimately call the shots on strategic alternatives. There are certain situations where the incentives may not be aligned between the Big 3 and minority public shareholders – with the most likely scenario being one where intrinsic value is clearly north of $50/share upon further execution, but the Big 3 is willing to settle for a lower price in a sale in order to realize liquidity for their partners and the LPs. But I hesitated whether to even spell this out because it would be a “first-world problem” – in that $50/share is almost an 80% premium to current prices. Finally, we can hope that HPS/GIC/Farallon can live up to their reputation as world-class investment firms and execute a sales process that maximizes value for all shareholders.

Conclusion

ATTO is one of my favorite exposures, and I believe that the eventual outcome here will be amazingly positive for investors with a cost basis anywhere near current levels. I have confidence in the management team to successfully complete the 3-year turnaround plan, and there is a good chance that the business is sold by this time next year for a very attractive premium above the Big 3 cost basis.

Considering the upcoming catalysts of (presumed) strong quarterly earnings and the Investor Day in November, I think it’s a matter of time before other sophisticated investors discover this opportunity and make their way to the shareholder register. Given how tight the float is, I expect the rerating to be explosive in short order.

Disclosure

Plum Capital is long ATTO common stock

Any update on this?

Do you have an idea of how much of their 2021/22 pipeline they have to win to achieve 2022 Rev/EBITDA target & how that compares to historical win rate? Also, what has been their historical recurring revenue rates? TIA.