Introduction

Welcome to my Substack, where I plan to post investment ideas in underfollowed stocks with compelling risk/reward and near-term catalysts for value creation. My hope is to generate quality research that resonates with both the motivated retail investor and the sophisticated buyside professional, and ultimately connect with other investors who may find such ideas interesting.

With that intro out of the way, the name I want to discuss today is Elevate Credit (NYSE: ELVT), which is an online subprime consumer lender in the US. I believe ELVT checks all the boxes – underfollowed micro-cap stock, available at an extremely cheap valuation, with multiple near-term catalysts on the horizon. I believe that ELVT’s stock price will double over the next 6-12 months, with modest long-term potential for a multi-bagger outcome if the Company is able to undergo a narrative transformation.

Business Overview

Elevate is a subprime consumer lender. The business model is straightforward, the Company conducts balance-sheet lending to individual consumers who have poor credit scores (typically below 650 FICO) or are “credit-invisible” (i.e. young adults or recent immigrants). To offset the high charge-off rates that one might expect from such a customer base, ELVT typically charges APRs in the 90% - 150% context. While such rates seem egregious prima facie, it is important to note that ELVT’s APRs are quite competitive versus the traditional payday lenders and mom & pop operators, where the sky is truly the limit (APRs of 300 – 500% are relatively commonplace). Consequently, the Company markets itself as a more “socially responsible” lender – on the basis that they: 1) charge lower APRs than much of the competition, 2) report customer activity to credit bureaus (therefore allows borrowers to build/improve their credit scores), and 3) offer ongoing APR discounts as the borrower builds a track record of successful repayments.

The Company has no brick-and-mortar presence (notable competitor, Curo, has an expansive footprint, as a contrasting example) and the entire process is conducted online, from initial application to underwriting and funding. ELVT’s product suite includes lines of credit and installment loans, under the “Rise” and “Elastic” brands, with loan sizes ranging from $500 to $5,000.

Situation Overview

Elevate Credit is currently trading at 0.82x Tangible Book and 2.6x EV/EBITDA on a pre-COVID earnings basis (ref. $3.68/share). This is quite punitive for a business with solid unit economics and has historically generated a large amount of FCF, but the setup here requires some explanation, which we will dive into.

COVID-19 impacted the business in several ways. Unsurprisingly, the Company was hammered through the crisis in March/April 2020, with the equity trading as low as 88c at the nadir. However, more important implications became clear as the Company started reporting quarterly results. First, demand for subprime loans contracted significantly, as consumers pulled back on discretionary spending and concurrently accessed liquidity through unemployment benefits and stimulus payments. The other side of the coin was a massive improvement in credit quality, as many borrowers acted with financial prudence, paying down high cost subprime loans with excess liquidity in their household balance sheets. The net result was quite an interesting one for Elevate, in that FY’20 revenues declined by 27% YoY, but EBITDA increased by 15%, driven by significantly lower charge-off rates and cost reduction initiatives.

The dual realities of weak originations demand and strong credit quality continued into 2021. 1Q numbers were in line with expectations, with credit quality remaining at all time highs while mgmt. guiding to a trough in receivable balances in 2Q, and growth resuming thereafter in 2H’21. As previously guided, debt balances were significantly lowered as the Company utilized the revolving feature in the credit facilities with the excess cash on the balance sheet.

Investment Thesis

It is helpful to kick off the discussion with the valuation framework, then dive into the nuanced merits of this investment. I’ve already mentioned that ELVT currently trades at 2.6x pre-COVID EBITDA (TEV of $334mm and 2019 EBITDA of $127mm) and 0.82x Tangible Book. But what is fair value? Well, we can look at a simple DCF first.

Make the following assumptions:

The Company reverts to pre-COVID earnings by 2022

Zero EBITDA growth thereafter

$20mm of maintenance capex (consistent with historical numbers)

Fully burden terminal value for taxes (currently not a cash tax payer due to NOLs)

Increase in debt in line with pre-COVID levels (to fund loan growth)

WACC of 12.5% (implies 35%+ cost of equity)

I believe the above set of assumptions are conservative enough to set the stage. This DCF exercise generates a TEV of ~$750mm, and backing out the pre-COVID level of debt, we arrive at $215mm of equity value, which implies $6.0 per share price (+64% upside from current).

But how confident can we be that earnings should recover to at least pre-COVID levels? There are three variables that support the contention: 1) credit quality, 2) cost structure and 3) demand for subprime credit. First, credit quality is at all-time highs, with charge-off rates improving by almost 1,100bps in FY’20 on a YoY basis (from 52% to 41% of revenue). There may be some structural tailwinds such as the tight labor market and rising wages, but we should assume that credit quality reverts to historical ranges at some point. Regardless, this won’t happen overnight, and therefore should be a positive contributor for the medium term. Second, controllable expenses have been cut to the bone, with the total cost structure declining by 38% in FY’20 (far outpacing revenue decline of 27% YoY). To be fair, some of this was marketing and other variable expenses that will come back when loan growth returns, but mgmt. has done a good job of cutting fixed costs too, including payroll, professional services and rent. This should allow for margin expansion when topline growth returns. Finally, I do believe that demand for subprime credit will return in time, as the excess household liquidity from stimulus payments and unemployment benefits is depleted. Various forms of pent-up consumer spending in the post-vaccine environment should be conducive to loan demand as well.

For the final data point on valuation, we can examine how the market valued ELVT since the IPO in 2017. If the stock can rerate to the historical average of 2.0x Tangible Book, then ELVT will be a $9 stock (+150% upside from current).

Closing the Valuation Gap – Share Repurchases

Hopefully I have laid out the case that the ELVT equity is cheap. But as most value investors know, cheap stocks can languish at low valuations for extended periods of time (or get even cheaper). I believe that ELVT is a compelling investment because there is an ongoing catalyst of aggressive share repurchases. Let’s review the history:

Simply put, the Company has taken full advantage of bargain-basement prices by aggressively repurchasing shares, reducing total share count by 18% since the first authorization in 2019. Management is acutely aware of how accretive it is to repurchase shares at these prices, and have made comments in every earnings call that buybacks will continue as long as the valuation discrepancy persists. The following are a couple of snippets from the 1Q’21 earnings call:

There were $21mm of authorization remaining after 1Q’21, and I believe that a reasonable portion of this has already been used up through June. I believe that the Company will authorize additional amounts, if the stock does not rerate in the interim. The Company had $140mm of unrestricted cash at the end of Q1, and continues to generate positive FCF each quarter. The Company requires about $50mm of minimum cash on the balance sheet for ordinary course of business, and no doubt mgmt. is earmarking a healthy amount to fund anticipated loan growth in 2H’21. However, I do not see any reason why an additional $20-25mm can’t be authorized in the back half of 2021, if the stock price continues to languish. Finally, the heavy insider alignment gives me comfort that mgmt. and the board will continue to allocate capital in a shareholder-friendly way. Insiders own more than 30% of the equity, which is an impressive amount of alignment for a micro-cap company.

Overhang – Insider Selling

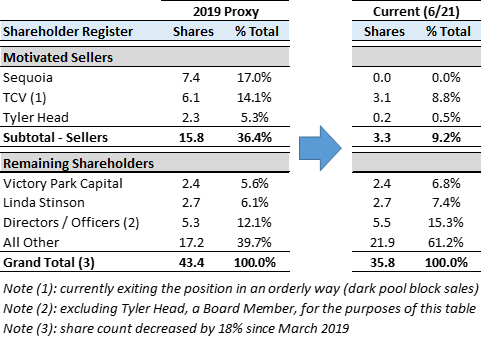

I suspect that astute readers are now asking what the catch is, and why the stock has remained downtrodden in the face of such a strong pace of buybacks. There is a simple answer to this question, and even better news is that the overhang is now abating. Share buybacks have largely been ineffective so far as there were 3 large, distinct shareholders who have been motivated sellers of stock in the open market. The below table summarizes this dynamic:

Multiple large holders dumping stock is certainly a red flag in most instances. However, I am quite confident that there are minimal concerns here from a fundamental perspective. First, it should be noted that both Sequoia and TCV have become shareholders from a legacy investment in the predecessor entity (Think Finance) in 2005. Because 15+ years have elapsed, it is my understanding (based on anecdotal color) that the shares are held in vehicles that are in the final stages of a wind-down. Given the size of those VC firms, their ELVT stake is virtually a rounding error for their investors and principals, which explains the price-indiscriminate selling. It is helpful though that TCV is selling their stake in dark pool transactions, which suggests that there is a size buyer on the other side.

Tyler Head is a somewhat different story. He is a board member, but is otherwise not involved in the day-to-day operations of the Company. Rather, it appears that he received his shares from his father-in-law Mike Stinson (founder of ELVT). The Stinsons are also no longer actively involved with the Company, and it stands to reason that Tyler Head has been selling down for his personal liquidity purposes, rather than as an expression of a negative outlook on the business. This is further corroborated by the fact that no other officer or director has disposed a significant number of shares.

Now that Sequoia is completely out of the picture, TCV is exiting in an orderly way and Tyler Head has almost finished unloading his entire stake, I believe that the selling pressure will abate imminently, allowing for the full force of the existing buybacks to be realized on the share price.

Investment Risks

I would be severely remiss if I did not address the risks involved with this investment. In my mind, there are three principal risks here. Let’s unpack them one by one:

1) The pace of credit demand recovery may be slower than we expect – this is for the most part a macro factor and beyond the control of the Company/mgmt. However, we probably need to see a return to growth before the equity markets allow for multiple expansion.

2) Deterioration of credit quality – as mentioned previously, we should underwrite to credit quality reverting to historical averages. Furthermore, degradation of credit quality due to poor underwriting is always a risk associated with balance sheet lenders.

3) Legislative risks – this is a permanent raincloud above the Company unfortunately. While there is nothing in the pipeline from a state-level perspective, there is some cause for concern for increased federal regulation under the Biden administration. The “worst-case” scenario here is obviously a federally mandated interest rate-cap set at levels below ELVT’s APR, and such legislation, if passed, would sink the Company – i.e. the Company would have to be liquidated in a managed run-off of the portfolio. While I don’t expect the equity to be a complete donut in such a scenario, it would certainly not be a good day for investors with a cost basis at current stock prices. While the probability of such event is quite low (more traditional lenders and credit card companies would also lobby hard against a federally mandated rate cap, if the proposed hurdle came anywhere near the rates at which they operate at), it is worth pointing out this corner case.

Closing Thoughts

I believe that ELVT represents one of the most compelling risk/reward profiles in the micro-cap space today, and would not be surprised to see the stock double over the next couple of quarters as the Company returns to growth and continues to buy back shares at attractive prices. It’s also worth mentioning that if the share price languishes for longer than we would like, this will lead to a “coiled spring” dynamic as more shares could be bought back for any given amount of authorization. In this instance, the upswing is likely to be more violent at the time of the eventual re-rate.

Please understand that I did not attempt to do a deep dive on business, nor try to underwrite a multi-year upside potential. But as a simple thought exercise, I think there is a slim (but non-trivial) probability of a blue-sky outcome 2-3 years out where the EBITDA grows closer to $200mm and the market rewards the execution with a mid to high single digit multiple. In that instance, the stock could be a 4-5 bagger from current prices. However, I do not have conviction in that line of thinking, and am personally more focused on a double here, which I expect to be eminently achievable in the next 6-12 months.

Disclosure

Plum Capital is long ELVT common stock and ELVT call options ($2.5 strike, Nov expiry)

Any new thoughts on this?

What do you think is the liquidation/downside scenario if the legislative interest rate cap is passed?