Introduction

True to my value-investing philosophy, and to the detriment of my net worth, I have stayed away from cryptocurrencies for my entire career. Admittedly I know very little about the underlying principles and the technology, and I do not like the idea of unhinged speculation – at least when it comes to my core positions. Not to mention I firmly believe that the majority of existing and future coins will ultimately turn out to be worthless – but that doesn’t matter, all I care about is presenting actionable investment ideas to my subscribers that satisfy my investment criteria.

So why am I suddenly talking about crypto? Well, I recently made my first investment in the crypto space, and I think this one deserves attention from the value-investing community. The Company is Mechanical Technology Inc. (NASDAQ: MKTY), which is an up-and-coming bitcoin miner that has been largely ignored by the market to date. We will dig into the story in detail, but here is the summary investment thesis:

Unconscionably low valuation – 3.5x EV/EBITDA and 28% FCF yield based on 1Q’22 run-rate

1Q’22 run-rate guidance may be highly conservative based on recent developments

Aligned and incentivized CEO with an impressive background in Private Equity

Significant embedded upside optionality (ESG, SOTP, BTC price and strategic alternatives)

Several catalysts to potentially make excess returns in the very near term (< 3 months)

Business Overview / Company History

MKTY has been a longtime OTC listing under its legacy precision instruments business (though it was uplisted to NASDAQ in March 2021). However, this business unit only does about $2mm of annual EBITDA and is immaterial to the overall value to the enterprise, so I think we can safely ignore this for the purposes of our discussion, maybe except for a potential sale to a strategic to unwind the SOTP dynamic down the road.

So the real story begins in 2020, when EcoChain was incorporated as a subsidiary to build out a crypto mining business. To get the ball rolling, MKTY purchased the assets of a bankrupt miner called Giga Watt, and signed up for hydro power to run the crypto mining operations in the Washington-based “TNT” facility. Given the advantaged position of having a low-cost power supply, operations were highly profitable (12 months payback for all capital invested) and management realized that this playbook could be replicated in much larger scale. This led to the development of “Python” and “Anaconda” facilities – both currently ramping as we speak.

Both Python and Anaconda will have an initial capacity of 25 MW (i.e. almost 10x larger than the 2.6 MW in place at TNT) and will utilize wind power provided by a coop which sources electricity directly from the Tennessee Valley Authority (“TVA”). Management has guided to both facilities to be fully ramped for the initial 25 MW target by 1Q’22, as facility construction and installation of mining rigs will be completed throughout the remainder of 2021.

Taking a step back, the business model is straightforward. The company mines for crypto (mostly Bitcoin, but some small amounts of Ethereum and Litecoin as well), and sells the mined holdings in the open market through a Coinbase account on a daily basis. The last point is very important – management is agnostic about BTC spot price, and unlike most other miners in the industry, does NOT speculate by holding BTC on the B/S. This is one of my favorite aspects of MKTY’s modus operandi – in fact this investment would have been very difficult for me personally if speculating on BTC was part of EcoChain’s business model.

Discussion on Earnings Potential and Valuation

With the general background out of the way, let’s talk some numbers. Bitcoin mining, although a commoditized activity, can be highly profitable if done in scale with a streamlined cost structure. The largest expense is of course electricity, and a reliable supply of low-cost power is crucial for economic viability of the operation. In this respect, MKTY is well ahead of the competition, as the supply agreements utilizing renewable energy have placed the Company in an advantaged position. To illustrate the business drivers more explicitly, I’m going to copy a slide from MARA investor presentation (one of the largest public miners):

With this in mind, please take a look at the below guidance given by MKTY’s management back in May 2021. If we assume that the Python and Anaconda sites can be fully ramped by 1Q’22, the earnings potential of the business is astounding at current BTC prices:

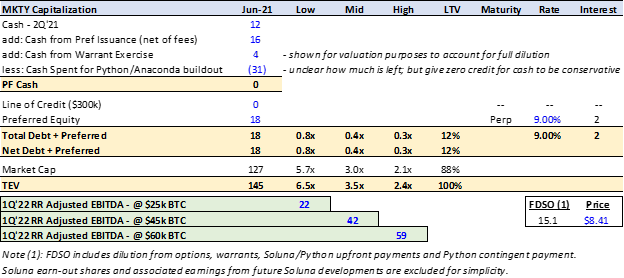

As can be seen above, the annualized 1Q’22 run-rate EBITDA for the business is $42mm at $45k BTC. Just to be conservative, let’s assume that the EBITDA generated by the legacy instruments business is eaten up by corporate as the business scales. What about the capital structure? Let’s assume the following to simplify the math:

All cash on B/S and cash raised through the Pref issuance are earmarked for growth spend

Include $18mm of recently raised Preferred in the EV calculation, but give no credit for cash

Use fully diluted share count, including options, warrants, upfront payments to Soluna and all dilution related to the Python facility

This gets us to 15.1mm of fully diluted shares. We need to be mindful of the fact that MKTY has acquired Soluna and there is associated dilution as expansion milestones are hit, but I think it’s totally fair to exclude this particular form of dilution and related future earnings to assess valuation as of today. So at the current stock price of $8.41, EV/EBITDA stands at 3.5x on 1Q’22 annualized and we have 28% FCF yield to market cap assuming $5mm of maintenance capex, $2mm of Pref dividends in cash and no immediate cash taxes as NOLs are utilized (and depreciation provides a further shield).

Pretty attractive already, but this is where the real fun begins. Recall that these were illustrative projections given in May 2021, and a lot has changed since then, mainly for the better. The crypto mining crackdown in China has radically altered the mining landscape in the near to medium term, creating a massive boon for ex-China miners. Why? Because miners are fleeing China en masse, flooding the market with mining equipment at fire-sale prices and significantly reducing network difficulty (relative measure of how difficult it is to mine a new block for the blockchain) as computing power is leaving the system. Of course we should assume that the dislocated mining equipment eventually finds a new home and China may even reverse their policies in the future, but this has created an unexpected set of positive tailwinds for the Company. Based on disclosures provided to date, MKTY has been purchasing the latest generation mining equipment (S-19s) at a discount, which could potentially increase the Company’s total hash rate beyond the 0.9 EH/s projected by 1Q’22.

As a final matter on this topic, the Company has also announced a hosting JV as part of the 2Q’21 earnings release, as follows:

I view this as a highly positive development, because not only is the ramp for the Python facility partially de-risked, we have an affirmation of the Company’s strategy from an independent 3rd party industry participant. This gives me further confidence that things are going in the right direction.

Considering all of these moving pieces, it suffices to say that the actual 1Q’22 results may come in significantly better than the old projections. I am hesitant to put a number out there, given my confidence interval is wide, but we don’t even need this to win because merely hitting $42mm of run-rate EBITDA as guided is enough for a strong re-rate, in my opinion. MKTY is planning to release an updated set of projections as early as some time in August, so we may not have to hold our breath for too long anyway.

Discussion on Management

I think a quick word on management is helpful before we move onto the catalysts. The CEO, Michael Toporek, has an impressive background with 30+ years of investment experience. He is the founder of Brookstone Partners, a NYC-based lower middle market private equity firm, which has been operating since 2003. Brookstone currently has 8 portfolio companies, including MKTY.

Brookstone Partners’ Fund XXIV owns 30% of current outstanding shares, and affiliated ownership will only increase going forward as former Soluna owners (Toporek et al.) are issued the contingent earn-out shares as Soluna executes. There is a separate management team for the day-to-day crypto mining operations, but Toporek is responsible for the overall strategy of the enterprise and the capital allocation decisions, a setup that I believe is quite favorable. The CEO stands to make a fortune if all the contingent shares are issued and MKTY stock performs well going forward. I believe that as earnings ramp throughout the remainder of 2021 and into 2022, there will be shareholder-friendly actions announced in short order, as mgmt. is highly incentivized to see a higher stock price.

Catalysts

Here is how I expect things to play out in the near term. The company releases EcoChain revenues and earnings on a monthly basis, and I believe that August and September numbers will be largely in line with expectations (or modestly better given China tailwinds), sending the stock higher as the marginal buyer gets more comfortable with the execution risk. Concurrently, the Company should be releasing updated projections (PF for the China mining ban and the purchase of S-19s) any day now, so I expect there to be a spike when the new deck drops (yes this offers a “quick-and-dirty” trading opportunity, but I am personally more interested in the multi-bagger potential over a longer time horizon).

Looking out to 2022, obviously 1Q’22 is a very important quarter as the first clean print with all 53 MW of capacity across 3 facilities fully operational. If everything goes as planned, I would not be surprised to see the stock doubling by then, but there is uncapped potential here as the business scales further beyond the initial target of 53 MW. Indeed, the Soluna pipeline suggests that there are hundreds of additional MW coming down the pike, but we do not need that to win big here. Finally, there is the ever-present possibility that BTC continues its upwards march beyond the current levels of $50k – which is just extra juice for us to squeeze. Yes BTC can drop too, we’ll talk about that soon!

Thinking even longer term, I expect this business to be sold to a strategic eventually. Once all the Soluna contingent shares are issued, I believe that Brookstone will move to monetize their stake (they are too big to exit in the open market under most all scenarios) as they are constrained by the fund life and carry expectations. It is very possible that MKTY is sold at a premium multiple, given the ESG angle and access to low-cost renewable power supply (and who knows what kind of synergies the buyer may be able to underwrite to). For the adventurous yet patient investors, it is not too difficult to conceive of a 10-bagger 2-3 years down the line if they can really scale this business and the BTC price stays buoyant over that time period. Highly debatable if I can make it that far, but let’s not get too ahead of ourselves – there will be many opportunities to re-evaluate the risk/reward in the future.

Risks and Mitigants

I thought it would be most efficient to tackle the discussion around risks in a Q&A format – these are the key questions I asked myself during diligence, and here is how I got comfortable.

Question 1: How can we get comfortable with the execution risk?

I’ll be honest. There is no way to get 100% comfortable with execution risk for an investment like this. There are several things that could go wrong – such as construction delays, shipping/logistics challenges and probably a half dozen other unforeseen risks that could put the timeline and earnings guidance at risk. As such this is why the opportunity exists and we are betting that the market is overly discounting the execution risk here. If the projects were much further along and de-risked, then the stock would not trade anywhere near current prices, in my opinion.

With that said, there are a few factors that give me reassurance that things are likely to work out as planned. First, in the 2Q’21 earnings press release (published on 8/10/2021) mgmt. reaffirmed the ramp expectations for August and September as previously guided. I think mgmt. are sophisticated operators and would not have said this unless they were very confident – because their credibility will be shot immediately if the monthly updates disappoint. Second, I take comfort from the Preferred Equity deal which closed on 8/23/21 – given that those investors presumably conducted private-side due diligence and got comfortable with the execution risk. Further, MKTY upsized the offering to $18mm (from $15mm previously) which is a positive data point as the Company likely saw strong ROIC from incremental equipment purchases, and the investor demand was there to meet the ask. Finally I am impressed that the Company was able to get the capital raise done at these terms: basically a toothless Pref with an acceptable dividend rate (9% cash or PIK) and no conversion option to Common Equity – given that MKTY does not yet have access to traditional debt capital markets.

Question 2: What if the price of BTC plummets?

Other than execution risk, this is probably the biggest risk to the thesis. However, there are numerous ways to hedge – you can short BTC directly, or you can short a basket of public miners and other crypto-linked equities. I am personally running the investment un-hedged for now, as I want to be able to capture any associated upside if BTC rallies, and the cheap entry valuation provides some cushion to the downside if BTC declines.

Question 3: Do you trust Management / Brookstone?

Brookstone is the controlling shareholder, with 30% of currently outstanding shares owned by Fund XXIV. If you include the earn-out shares that will be paid out to former owners of Soluna (Michael Toporek owned 90% of Soluna before it was acquired by MKTY), then PF ownership by Brookstone and affiliates would increase to ~38%.

Therefore, I find comfort in the fact that Brookstone and the CEO are highly aligned and incentivized by their equity ownership. Also, the acquisition of Soluna removes all related-party risk as all operations are now brought under the umbrella of the HoldCo (Mechanical Technology Inc.). Soluna leadership has become MKTY employees, and everyone is now incentivized to see success at the MKTY level – given that most all purchase price is in the form of contingent MKTY shares issued as milestones are hit in the future. This is a powerful argument because any form of short-term game theory dictates that keeping Soluna as a separate entity would be preferable if there were ever any unscrupulous intentions (i.e. extracting inordinate value from MKTY to benefit Soluna). This transaction is a huge vote of confidence from the insiders for future value creation potential by the PF company.

Question 4: Doesn’t EcoChain play in a commoditized industry with zero barriers to entry?

This is true. Anyone with a computer can mine bitcoin. However, to do it in scale you need a reasonable access to capital to secure physical space and purchase dedicated mining equipment. Not to mention a low-cost power supply is required for the enterprise to be economically viable. This isn’t to suggest that there are high barriers to entry, in fact it is relatively straightforward to get into the crypto mining business (EcoChain’s rapid projected growth is testament to this as well) and there is competition from every corner of the world, given that the activity is not constrained by geography.

From an investor’s perspective however, this is an easy problem to solve – you just have make sure that the entry valuation is attractive enough to justify investing in a truly commoditized industry with zero competitive advantage. With that said, MKTY is somewhat differentiated because 1) the Company’s operations rely purely on low-cost renewable energy and 2) it is led by a rational and aligned management team focused on ROIC and shareholder returns.

Question 5: How capital intensive is this business?

This is a very important question, yet difficult to answer precisely because there are so many moving parts. Mining equipment chip cycles are relatively short, as newer generation models are released on a regular basis. Industry experts estimate the typical life cycle of equipment to be no longer than 12-18 months, and therefore depreciation is a real expense, and the window for earning the appropriate return on capital is short. There is a global chip shortage going on right now which complicates matters a bit, but let’s ignore this for simplicity.

So here is where the cost structure becomes a very relevant factor for capex decisions – whether to always upgrade to the latest equipment as soon as possible, or sweat the assets for the tail of residual earnings. MKTY has a competitive advantage here from having some of the lowest power costs in the industry, at $0.023/kwh. Therefore EcoChain does not always need to run the latest gen equipment to be solidly profitable – indeed the recent ongoing upgrade to S-19s was a very opportunistic decision from the Chinese mining ban, and was not part of the original set of projections given earlier this year.

So what is the bottom line here? I think that $5mm is a reasonable estimate for maintenance capex for the 53 MW run-rate, and I arrived at this number by looking at how much the Company spent for the TNT facility buildout, and applying similar ratios for Python and Anaconda. As MKTY scales beyond the initial target of 53 MW, we should naturally expect capex to scale up proportionally. However, it’s also worth mentioning that there is “upside” from the Company signing up more hosting contracts in the future, which provides excellent optionality as long as MKTY is able to negotiate attractive terms for the revenue share. MKTY gets capex-free earnings, and the market should assign a higher multiple to this earnings stream as well once the numbers flow through to the financials. Finally, based on my discussions with management, I believe that the Company will start to give capex guidance at some point in the coming quarters, to get investors more comfortable with the story.

Question 6: Why does this opportunity exist?

There are two main reasons I can think of. One is the usual micro-cap dynamic that we are all too familiar with – liquidity constraints, poor IR/marketing function, zero street research coverage, etc. The second is that the business has a lot of hair too – execution risk, BTC price risk, and the presence of the legacy instruments business which creates a potential GoodCo/BadCo dynamic and is confusing for the marginal buyer taking a cursory look.

I also believe that MKTY is simply not yet on anyone’s radar. The EcoChain subsidiary was incorporated in 2020, and MKTY was only uplisted to NASDAQ from OTC in March of 2021. As such, management has not yet had a chance to meaningfully build out IR functions and market the company to the broader universe of public market investors. I think that publicity can only get better from here, and as such is all part of the opportunity.

Conclusion

I believe that MKTY is an attractive opportunity to get some crypto-related exposure for value investors for the reasons discussed in the writeup. I also like the idea of potentially getting paid in the very near term, as I believe that solid execution in 3Q in line with guidance will provide proof of concept and attract a lot more investors to the stock. I believe MKTY could easily double within 6 months or less, and depending on how the stars line up (BTC price, global hash rate, upside from better equipment, etc.) we could see a potential multi-bagger outcome in the next 12 months.

Disclosure

Plum Capital is long MKTY Common Stock

I’d like to thank Kingdom Capital (@Kingdomcapadv on Twitter) for introducing me to MKTY and helping me with certain aspects of due diligence. I’d encourage any interested readers to check out his excellent work on MKTY as well – linked here

I’d also like to thank David Fauchier (@dfauchier on Twitter, PM at Nickel Digital) for being generous and answering my crypto 101 questions

Thanks, Plum. If they can execute and get the projected hash rate online, $42MM will probably be VERY conservative in my opinion. The huge decrease in global hash rate has allowed and will continue to allow efficient miners to generate more BTC than previously projected - global hash rate right now is ~138 EH/s compared to their projections in the table above, which could obviously not take into account the China hash rate exodus (or at least the timing and rate at which it would occur). Up until the recent difficulties adjustments, miners were at or near their most profitable levels ever (revenue per TH/s). As long as the BTC price can outpace the difficulty adjustments going forward, miners will remain at higher or constant profit levels and sentiment should remain positive. Global hash rate will continue to increase as miners get delivered, but that will take time and I believe BTC selling pressure will continue to subside as bitcoin is mined by efficient, profitable miners that are not forced to spot sell BTC to cover operational costs. As you mentioned, MKTY is in the minority by selling all of their BTC rewards, while most other publically traded miners are more focused on accumulating. I agree that this is a shorter-term play - I do not know how the market will react when people start talking about the 2024 halving, but I'm happy right now to own the miner that is extremely undervalued compared to its competitors. Cheers!

So ... I just had someone pitch me a series B or C (I forget) investment in US Bitcoin Mining ... a clean energy powered, yada yada, you get the drift ... for a cool 1bn pre money if I recall correctly, with current mining of 6BTC per day, so call that ~130m m in revenue for the year, which supposedly on an EV to hash rate basis is cheap ...