$HALL - Quintessential Greenblatt-style Value Investment

Spinoff of Core Profitable Business should Unlock Value

Introduction

Let’s cut to the chase – Hallmark Financial (NASDAQ: HALL) is one of the most egregious mispricings that I’ve seen in my entire career, for an immediately actionable opportunity. The equity currently trades at $4.25/share, I see fair value at around $8.00/share (+88% upside) and there is further optionality to $10.00/share (+135% upside) if the market reprices the equity in line with bottom-quartile public peers.

But in the land of Plum Capital, cheapness alone is never enough. This opportunity approaches “no-brainer” territory for me, as multiple near-term catalysts will likely rerate the equity substantially closer to my assessment of fair value within 3-4 months, while the comically low valuation affords downside protection in the interim. Without further ado, I present to you the following catalysts:

Separation and IPO of HALL’s profitable Specialty Commercial business (“SC”) in 3Q’21

Accretive use of IPO proceeds to close the valuation discount

Continued inflection in the underlying business, as initially evidenced in 1Q’21

I believe the massive discount to fair value exists because the Company is a relatively unknown micro-cap with a messy history that has been “left for dead” by the market. I believe that once HALL markets and successfully executes the SC IPO, and concurrently prints another quarter of strong results, the discount will rapidly close, leading to spectacular IRRs for the equity assuming cost basis at or near current levels.

Business Overview

I will assume that most subscribers have a basic understanding of how an insurance business works. Hallmark Financial focuses on Excess & Surplus (“E&S”) lines for small to mid-sized enterprise risks in specialty/niche markets. In layman’s terms, this is providing more complex insurance products that standard carriers will not generally cover. Because you are providing a bespoke product, underwriting those risks requires additional expertise, and as such well-operated E&S insurers can earn superior returns on capital versus more commoditized standard insurance providers. The latest public investor presentation has some great slides to show the composition of risk that HALL is underwriting, and I encourage you to take a read:

https://www.hallmarkgrp.com/investors/presentations/

Valuation Framework

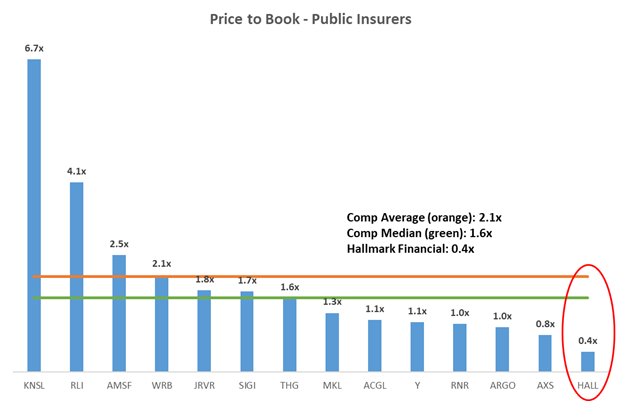

Before we dive into the more nuanced topics, I want to highlight how cheap HALL really is. We know that Price to Book is the most conventional way to value an insurance business, so what I have done below is aggregate all the publicly traded insurers in the US and calculate the P/B values by taking the most recently reported Book Equity number (from 10-Q filings for the March ’21 quarter) and the current market cap. This exercise results in the following chart:

I hope you agree that this is an eye-opener. HALL is a massive outlier on the RHS, with a P/B of 0.44x (or BVPS of $9.91), a valuation that is at a whopping 50% discount to the next cheapest comp, Axis Capital. But that’s not the end of it – HALL has basically no intangible assets or goodwill accounted for on the B/S (only $1.2mm of intangibles and a Book Equity value of $180mm). So, if we were to compare P/TBV instead, the valuation discount for HALL becomes even more gargantuan versus the public peer set. But we need to be cautious, relative valuation can be a very dangerous tool to rely on, if the target entity has legitimate reasons to be trading at a discount. After all, HALL is quite subscale versus comps, and has a checkered history. Therefore, I think it is more helpful to look at how HALL itself has traded historically:

This chart is also very instructive. Reflecting the fact that HALL has been a serial underperformer and subscale operator, the Company has never traded above book value since 2008 (save for a very brief spike in 2019). So it makes sense that the long-term historical average for P/B shakes out at around ~0.8x. But what captured my attention was how HALL traded during and after the COVID meltdown of 2020 – P/B troughed around 0.27x and has hardly recovered since (relative to pre-COVID and historical average), as the current valuation stands at 0.44x. This is shocking to me – of the companies on your watchlist, how many have remained near COVID lows? I’m sure you can think of a handful, but I am willing to bet that in most of those cases, the company is either facing terminal risk, or has idiosyncratic issues that prevent the recovery in line with the general market. But is it fair to lump in HALL with that crowd? My answer is a resounding no, and I will spell out the reasons shortly. If HALL’s valuation can revert to the historical average, it will be an $8 stock (+88% upside).

Why Does This Opportunity Exist?

Now we must have the obligatory discussion of why the market is handing us this gift. Let’s get the easy stuff out of the way – HALL is an illiquid micro-cap company, so this is only actionable for individual retail investors or funds with a dedicated strategy for smaller-cap names. This blocks out a large contingent of the institutional buyside community due to liquidity constraints. Furthermore, the Company has zero sell-side coverage and does not conduct quarterly earnings calls, and therefore it is perhaps not a huge surprise that the market has not yet picked up the $100 bill lying on the ground.

However, I think the above is too lazy of an assessment on its own. Indeed, if you look at the historical financial performance, HALL’s metrics are subpar – often losing money or barely breaking even. In fact, of the past 6 years (from 2015 to 2020), the Consolidated Combined Ratio was at or above 100% for 4 of them. So what exactly was the problem? Well, the Company had significant exposure to deeply unprofitable businesses (Binding Auto and runoff lines – now all completely discontinued) which obscured the highly profitable nature of the core Specialty Commercial business, which accounts for majority of the written premium (Standard Commercial and Personal Lines are much smaller segments). The Company illustrates this point well in a slide from the 4Q’20 Investor Presentation as shown below – but the message is, the market had given up on the Company given how unprofitable the business was in both 2019 and 2020.

Catalyst #1: IPO of the Specialty Commercial Business

So then, let’s move onto the meat of the thesis – the catalysts. The insiders are not stupid, they saw the massive valuation discount and decided to do something about it – and in a smart way, in my opinion. They are going to separate the highly profitable Specialty Commercial business and conduct an IPO as a stand-alone entity. To help explain what’s going on, I’ve snipped the press release and highlighted the important sections in yellow:

I believe that this is a concrete catalyst that will unlock a huge amount of value for the Company. Why? Because investors will be given an opportunity to get exposure to just the highly profitable Specialty Commercial segment of the business, while leaving the ancillary baggage behind. Just as important, I believe half the problem here is the lack of market awareness for HALL– once mgmt. begins the IPO roadshow and tells the story to prospective investors, I suspect that the market will salivate at the opportunity to get some cheap exposure to a highly profitable E&S insurer, when the insurance market conditions are favorable (a bit out of scope here, but many public comps have talked about a firm pricing environment or “hardening” of the market in recent periods).

It’s up to the market to price the IPO of course, but I believe that there will be investor demand at significantly higher P/B than where HALL is trading today – I would not be surprised if the IPO priced at somewhere between 0.7x – 1.0x P/B, which would be a fantastic outcome, despite the fact that the valuation would still be at the bottom of the peer set.

Catalyst #2: Likelihood of Capital Return

The second leg of the thesis is what HALL would do with the IPO proceeds (50% stake of the Specialty Commercial segment will be sold, as highlighted above). This gives the Company significant optionality, given that there are multiple accretive ways to spend the cash. HALL could authorize a share buyback program, pay a dividend to shareholders, or tender for the shares (or some combination). There is always the risk that mgmt. does something erratic like a horribly dilutive acquisition, but it’s more likely that mgmt. will do the obvious thing and return capital to shareholders, in my view. This would provide significant upwards momentum for the stock price, if the shares have not already rallied by then.

Catalyst #3: Inflection in the Underlying Business

As a final matter, the improvement in the underlying financial performance gives me additional comfort for this investment. As a result of discontinued operations no longer running through the financials, and the strong pricing environment for E&S, the Company reported an excellent 1Q’21, with the Specialty Commercial segment printing 87.8% Combined Ratio, and the remaining segments materially improving performance on a YoY basis as well. Furthermore, Net Income came in at $9.3mm – a remarkably strong figure given that if you annualize this performance (i.e. $37.2mm) this equates to 50% of current market cap, a situation that would not make sense in any state of the world.

But that is too simplistic – the quarter included $5.8mm of investment gains, which are of course unpredictable and subject to wild swings depending on market conditions. So if we back this out completely (quite conservative way of looking at things), then Net Income would have been $3.5mm (plus some reversal of taxes, but let’s ignore this for simplicity). If we annualize, then we arrive at $14mm or 18% yield on current market cap, still an extremely generous number. Even if we completely ignore the IPO-related hard catalysts, I think there is plenty of upside in the stock from the Company continuing to report strong quarters, eventually changing the narrative and attracting more investors into the stock.

What If You’re Wrong?

There are always risks to an investment, and this one is no exception. First, the IPO could be a total flop – maybe there is little demand for micro-cap insurer equities, and the IPO gets done at a terrible valuation or gets pulled altogether. Maybe HALL regresses to reporting poor earnings. Maybe there are yet more skeletons in the closet like the Binding Auto exposure. I think these are all legitimate risks to this investment, so I am not going to hide from them. However, I also think that a core strength of my investment style is a maniacal focus on valuation – and the rock bottom entry valuation here protects us from catastrophic downside in my opinion. Ultimately I believe this is a highly asymmetric payoff profile, where I will double my money if I am correct, or break-even/lose a small amount if I am wrong. Finally, the score will be settled in 3-4 months or less – so either way, my capital will not be tied up here for eternity.

Disclosure

Plum Capital is long HALL common stock

Special thanks to my friend @hareng_rouge for bringing HALL to my attention a few months ago. He’s a must follow on Twitter for anyone interested in small cap value!

Plum, do you know what % of total book value is still attached to the discontinued lines? Not clear to me if there are net assets remaining post LPT-transaction.

Also related to the LPT transaction: do I read correctly that above $240m in total losses, HALL will bear all the claims, vs. a total of $182.8m as of 31 March 2021. (cf. "As of March 31, 2021, the ultimate incurred losses from the subject business were $182.8 million or $6.7 million in excess of the Hallmark Insurers’ loss corridor.")?

What happened after 2018 to justify such a deterioration in business fundamentals in their Personal Line and Standard Commercial business? They attribute half of it to PYD in their discontinued business, but what about the other half? Have they addressed those issues? If they can get back to 2018 Combined ratios #s, it could be an interesting turnaround story with the IPO.